Claim Your Gift by Following Steps:

a. Share your experience by writing a review on amazon

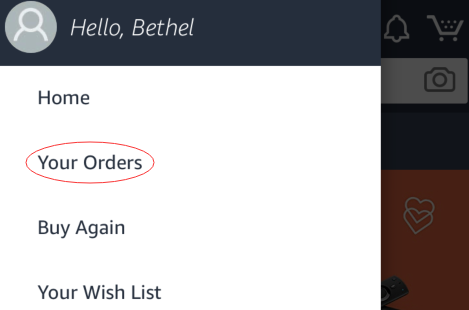

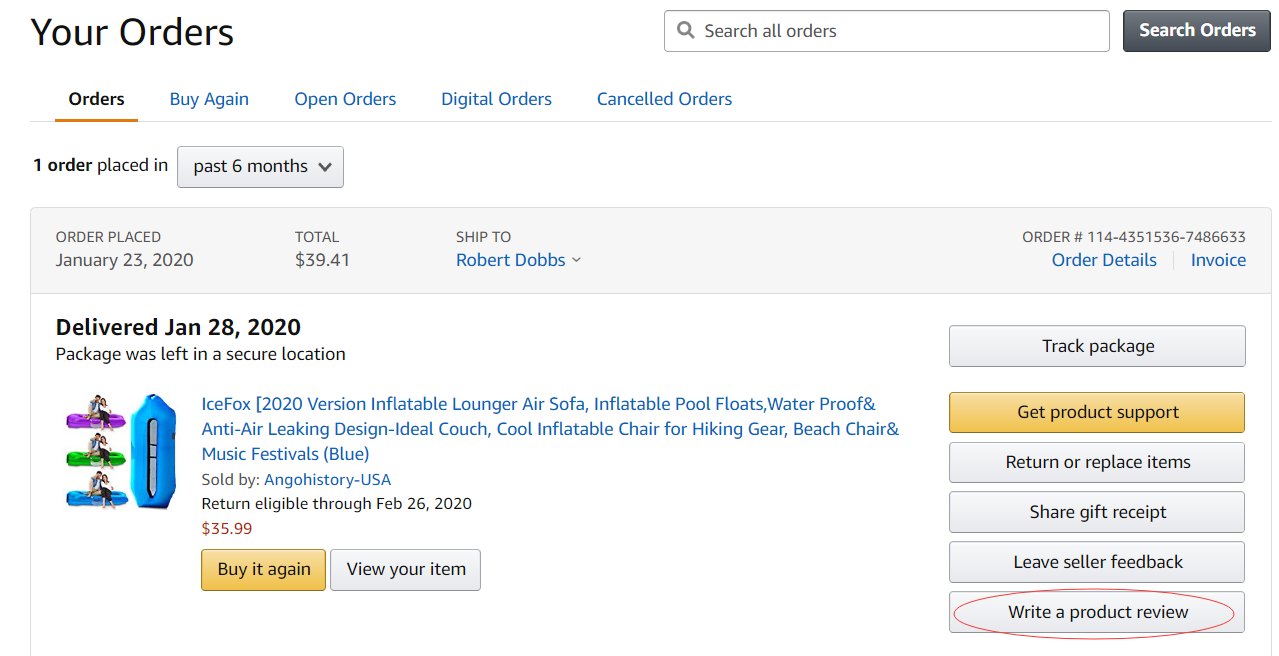

1. Sign into Amazon account and then click "Your orders"

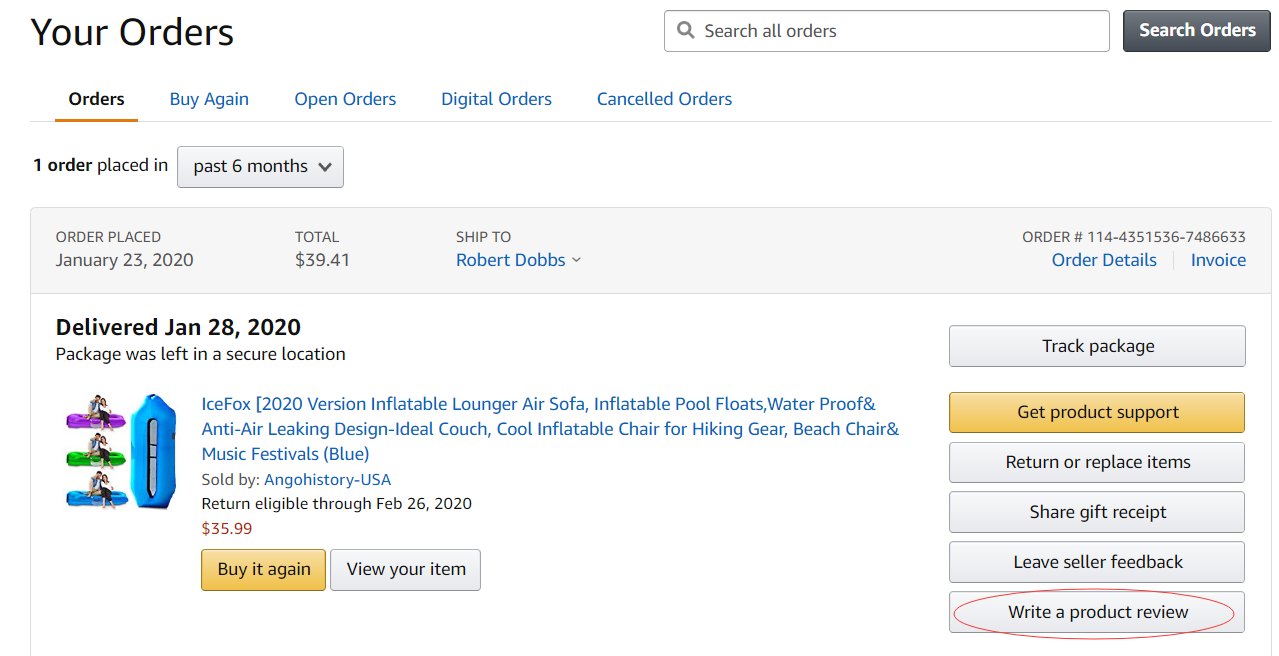

2. Click "Write a product review"

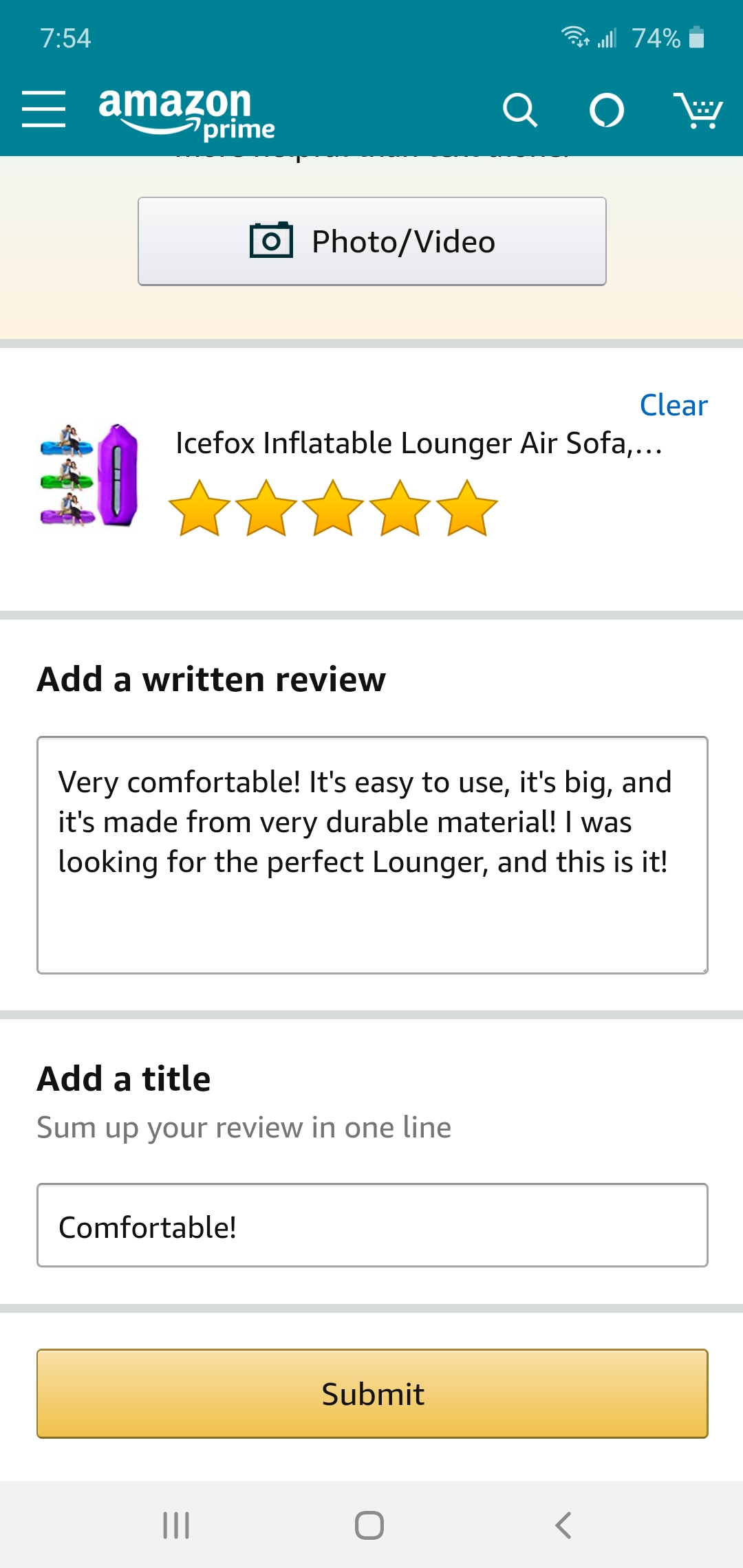

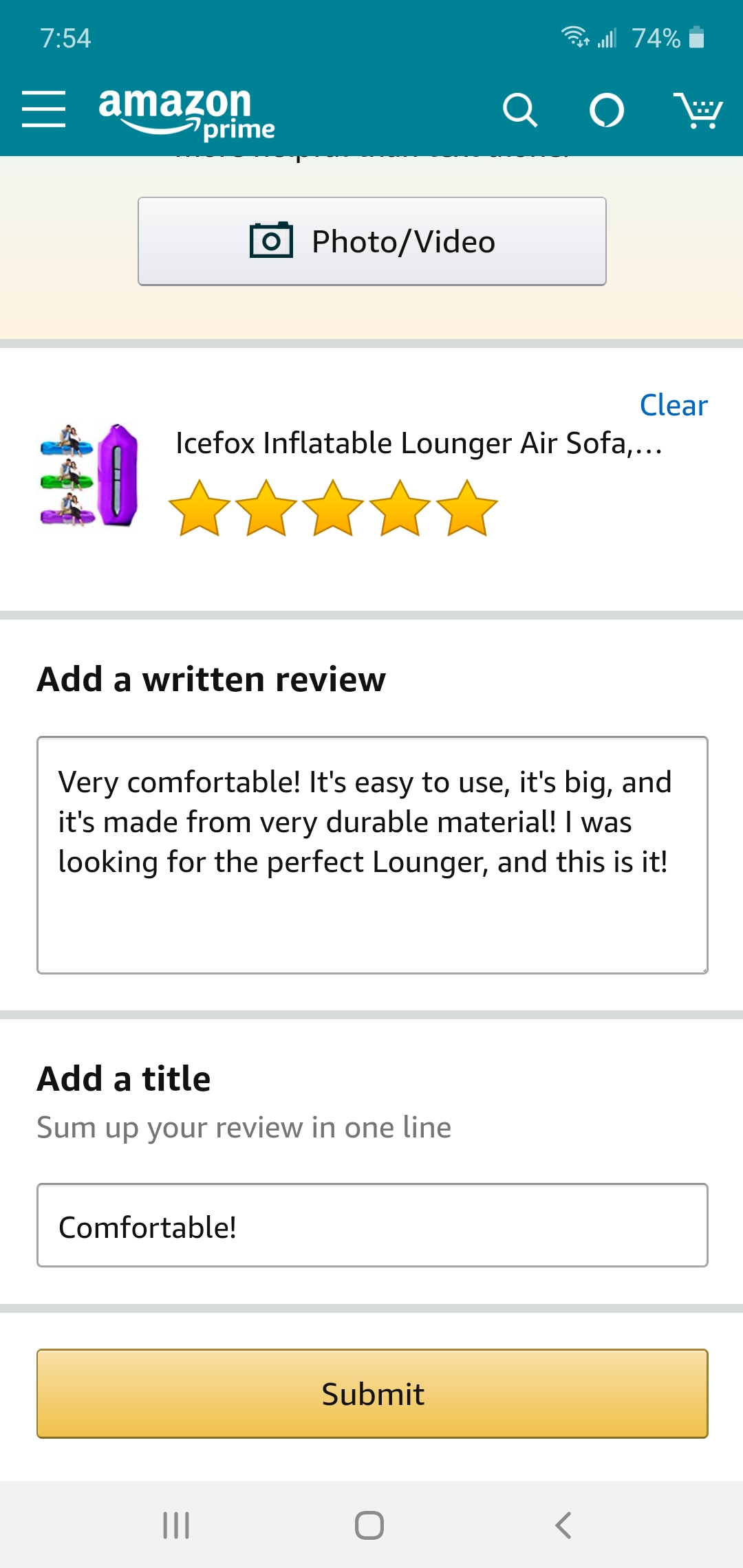

3. Write a review and then Submit

b. Fill out the form on the right.

No Shipping Charges | No Credit Card Required | No Hidden Fees